- AME CAPITALS

- Trading Technology

- Help AME Trading

Chapter 18. Commodity Currencies in Forex

As we have already learned from previous chapters, the value of a currency is determined by multiple factors, including economic, political, psychological, and others. All these factors, to some extent, influence the exchange rate of a specific country's currency – some factors more significantly than others. However, in the Forex market, there are currencies whose value is predominantly determined by a single factor – the export of their respective countries. Such currencies are known as commodity currencies in Forex.

The specificity of commodity currencies lies in the fact that their countries' economies are heavily reliant on the export of a specific type of commodity, such as oil, gas, precious metals, or agricultural products. There are many countries that fall into this category, but the main ones are Canada, Australia, and New Zealand. Since the currency in these countries is the dollar (each with its own variant), they are commonly referred to as commodity dollars (comdolls) in the context of Forex. The fact that commodity exports are a determining factor for the economic health of these countries means that an increase in the price of the corresponding commodity in the global market leads to a strengthening of the national currency, and vice versa. Therefore, there is a correlation between the price of commodities in the global market and the value of the commodity currency.

The Canadian dollar (CAD), Australian dollar (AUD), and New Zealand dollar (NZD) are among the major currency pairs traded in the Forex market. Therefore, studying their characteristics as commodity currencies is an integral part of successful trading in the currency market. Let's take a closer look at each commodity currency and provide comments on each of them.

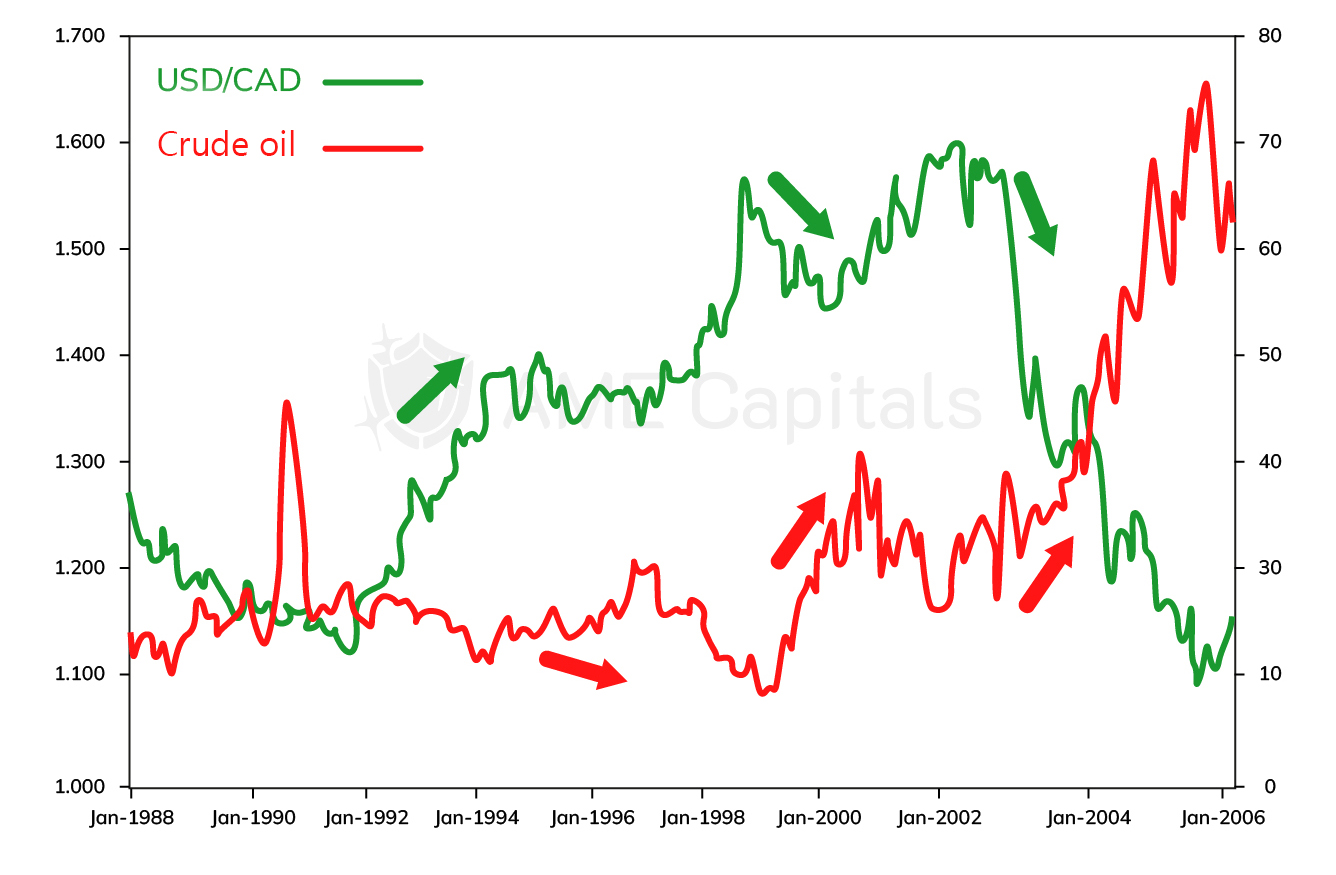

Canada is renowned for its oil reserves, which are second only to Saudi Arabia in terms of size. Oil is often referred to as "black gold," indicating its high demand on the global stage. Thus, thanks to its advantageous geographical position, Canada is the largest exporter of oil in the world. Conversely, the United States faces a shortage of this resource and is its largest importer. Therefore, changes in oil prices are reflected in the USD/CAD currency pair in an inverse proportion. An increase in oil prices leads to a decrease in USD/CAD (weakening of the US dollar), while a decrease in oil prices leads to an increase in USD/CAD (strengthening of the US dollar). Hence, there is an inverse correlation between oil prices and the USD/CAD exchange rate. Since January 1988, the price of oil and the USD/CAD exchange rate have had a reverse correlation of over 68% - a fairly strong relationship! Knowledge of this fact can be a useful additional tool in forecasting changes in the USD/CAD exchange rate in the Forex market. The graph below illustrates the correlation between oil prices and the USD/CAD exchange rate from January 1988 to January 2006.

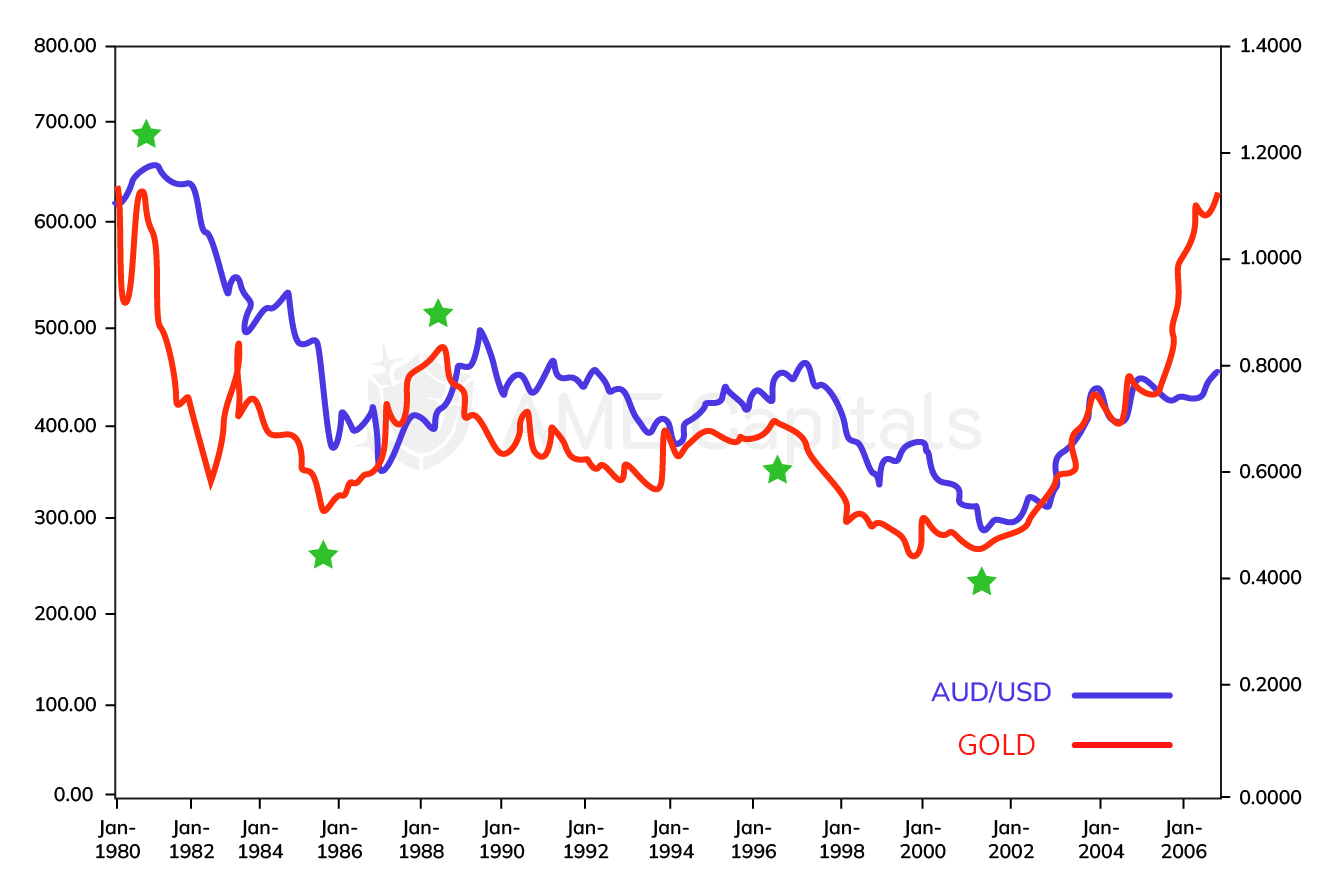

The economy of Australia is heavily reliant on the export of gold and jewelry, which accounts for over 50% of the country's total exports. This is due to Australia's abundant gold deposits, facilitated by its advantageous geographical position. The global price of gold and the AUD/USD exchange rate have an even stronger correlation than the global price of oil and the USD/CAD exchange rate. From January 1980 to 2006, fluctuations in the AUD/USD exchange rate and gold prices were nearly identical, as can be seen in the graph below. Moreover, there was a tendency for gold price reversals to slightly precede the corresponding reversals in the AUD/USD exchange rate, as indicated by the asterisks on the graph. In 2005-2006, the correlation shifted when gold significantly increased in price, but there was no corresponding rise in the Australian dollar (AUD) against the US dollar (USD). Nevertheless, the long-term correlation still holds and can be used as an additional forecasting tool in Forex trading. It should be noted that the global price of gold and the AUD/USD currency pair have a direct correlation.

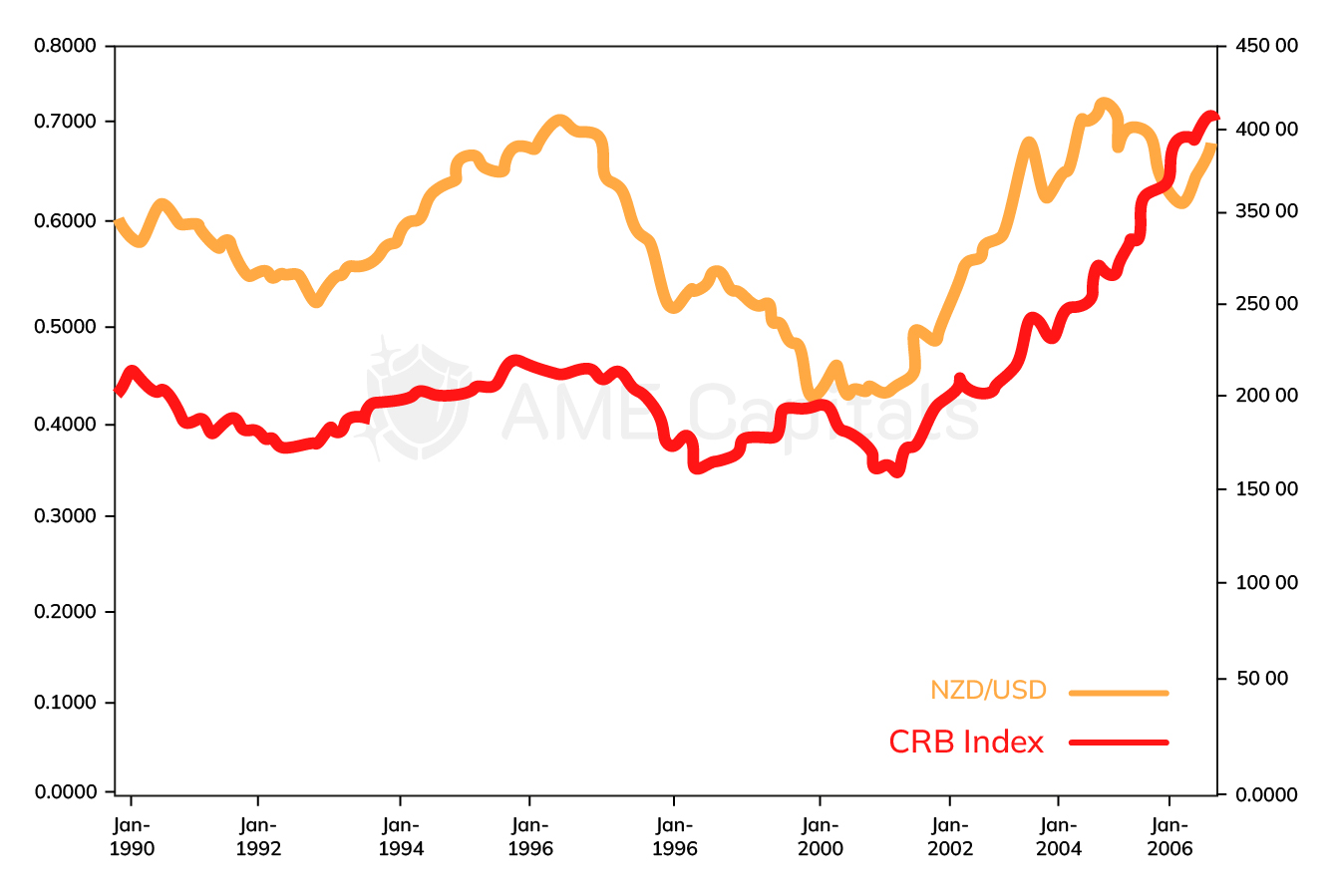

The economy of New Zealand, like that of its western neighbor, is heavily dependent on exports. However, unlike Australia and Canada, New Zealand does not have a predominant single commodity in its exports. The country exports dairy products, meat, fish, timber, wool, and more. Due to the diversity of the country's exported commodities, the correlation between the prices of these commodities and the exchange rate of the national currency against the US dollar is determined using the Commodity Research Bureau Index (CRB Index). This index represents a basket of leading global commodities and also serves as an indicator of global inflation. The value of the CRB Index and the NZD/USD exchange rate have a direct correlation. The graph below shows that approximately 60% of such correlation was observed from January 1990 to January 2006. As can be seen, the NZD/USD exchange rate is heavily influenced by global commodity prices. Understanding this fact can serve as an additional tool in the arsenal of analysis and forecasting in Forex trading.

In conclusion, it is important to consider the correlation between commodity prices and the exchange rates of commodity currencies in Forex trading only in the medium and long term. It is also important to remember that exports are just one part of a country's economy. When making decisions to open or close positions on commodity currencies in Forex, it is necessary to take into account other factors that influence the country's economy, such as refinancing rates, political situation, and so on.